Why Work with a Fiduciary?

Our approach, process, and how we are compensated are transparent from the beginning. GreenStar is a fee-only investment advisory firm that provides holistic and comprehensive planning and investment management that is free of personal conflicts of interest.

We feel that so much of the financial services industry is stacked against the consumer. Backdoor payments, hidden fees, proprietary products, not always putting the client’s interest first, and what we call “transparent dishonesty” – this is when you are told everything in fine print buried in documents you probably won’t read.

The world is very complicated and particularly the investment world. It’s not realistic that a consumer can always monitor the changing landscape. It is a full time job to keep on top of it and a lifetime to learn it. The problem is that you need this knowledge and experience as early in your life as possible to maximize the benefit. To us, the realistic alternative is to hire someone who has this expertise and is legally bound to operate in your interest. This is what’s called a fiduciary.

What is a fiduciary

The Securities and Exchange Commission (SEC), which regulates registered investment advisors as fiduciaries, describes the fiduciary duty:

This is what’s called the Fiduciary Standard.

• Acting with undivided loyalty and utmost good faith

• Providing full and fair disclosure of all material facts, defined as those which “a reasonable investor would consider to be important”

• Not misleading clients

• Avoiding conflicts of interest (such as when the advisor profits more if a client uses one investment instead of another or trades frequently) and disclosing any potential conflicts of interest

• Not using a client’s assets for the advisor’s own benefit or the benefit of other clients

Aren’t all Financial Advisors Bound to the Fiduciary Standard?

Shockingly, no. Being a “Financial Advisor” can mean a lot of different things. Sometimes they can work for a bank, insurance company, or brokerage firm. A broker is a salesperson who earns money off commissions which presents many conflicts of interest. The product they are recommending may pay them more than a product better suited for you, one that they may not even tell you about.

You should make sure you know everything about how your advisors make money, especially before working with one. Sometimes people come to us because they want to know if their advisor is a fiduciary or not. We realize that it can be awkward to ask someone directly. You are welcome to bring any name to us and we can show you how to tell the difference.

What does this Mean?

We strongly feel that people should only hire professionals bound to work in their best interest. Let’s imagine you were choosing between two contractors to remodel your kitchen. Contractor #1 is legally bound to use their expertise to get you the best pricing on materials, tell you the full truth, not mislead you, transparently tell you all costs and fees, avoid conflicts of interest (and tell you if any exist), and to ultimately put your interest above the contractor’s. Contractor #2 is not bound to any of this and may be earning more money based on what they are advising you, they may recommend certain appliance brands because they get paid more by the manufacturer, they may be receiving backdoor payments from subcontractors, and generally have no obligation to work for your best interest.

To us, the choice is obvious. We strongly believe in the Fiduciary Standard. Unfettered by affiliations with any bank, broker-dealer, or investment bank, GreenStar is positioned to put your goals first and deliver objective advice free of conflicts.

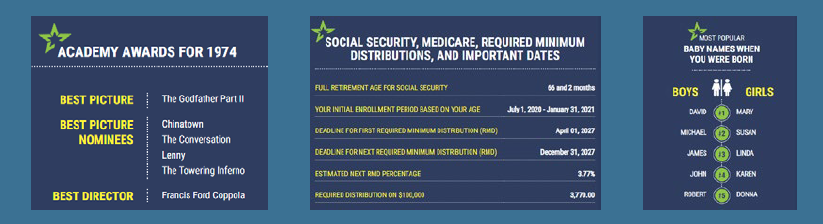

Find Out Everything About The Day You Were Born!

What were the most popular baby names? What day of the week was it? How much was a loaf of bread?