Aligning Interests

GreenStar Advisors is a fee-only fiduciary financial advisory practice in Centennial, DTC. That’s a mouthful, but a very important one. In our view, the most important question you can ask a potential advisor is, “How are you paid?” And for extra credit, ask, “If I work with you, will you be my legal fiduciary for all accounts with you?” The key word there is “all.” Please feel free to contact us to know more about our financial advisor fiduciary services.

What is a Fiduciary?

A fiduciary is someone you hire to act on your behalf that has the power and responsibility of acting for another.

It is the highest legal duty of one party to another requiring absolute good faith and honesty. A fiduciary is ethically and legally bound to put their client’s interests above their own. They manage your assets for your benefit, rather than for their own profit, and cannot personally benefit from the investment decisions.When you hire a fiduciary financial advisor in Centennial, DTC , you are hiring someone bound to work for your best interest. It is like hiring an expert extension of you. A financial advisor working in this capacity is working for you under the Fiduciary Standard.

Suitability vs. Fiduciary Standard

The alternative to the Fiduciary Standard is the lessor Suitability Standard. A broker, who works for a broker-dealer, is likely operating under the Suitability Standard. In fact, some broker-dealers in Centennial, DTC do now allow their brokers to be fiduciaries. A broker-dealer is acting in the role of a salesperson who earns a commission when they steer clients into particular investment products (including mutual funds, annuities, or alternative investments).

Earning a commission for advice is a clear conflict of interest. It’s important to work with advisors providing unbiased advice that is in your best interest, and not simply selling you investment products.

Confusingly in Centennial, DTC , there are some advisors who do fiduciary financial advisory investment services in Denver are fee-based (not fee-only) who are dual-registered financial advisors. This means that they are registered as both fiduciary investment advisors and brokers and can wear either hat. Because of this duality, it may not be clear which hat they are wearing when you go into a product. When meeting with you, a dual-registered advisor may act as your fiduciary one minute and as a salesperson the next.

This is why it’s key to ask any potential advisor, “If I work with you, will you be my legal fiduciary for all accounts with you?” Otherwise, there are clear conflicts of interest in the advice they provide. In our experience, most people falsely believe that all advisors are legally required to act in their client’s best interests. This wrong assumption has exposed people to biased and costly advice from advisors who put their own interest before investors.

Hire Someone Who Works for You

Not all advisors are required to put you first. Only fiduciary financial advisors are required to act in your best interest. When choosing a financial advisor in Centennial, DTC for fiduciary financial planning you should ask him or her very directly, “Are you a fiduciary?” If you hear anything but a direct answer, it’s possible they have a toe in the commission pond. If the advisor tells you they are a fiduciary, ask them to show that to you in writing.

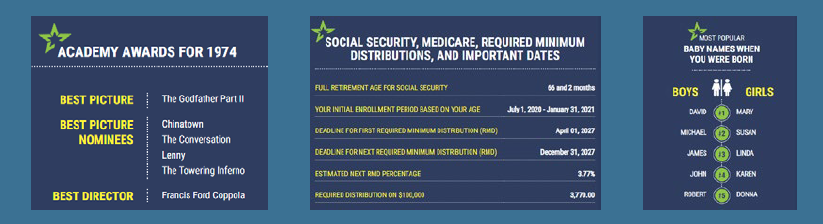

Find Out Everything About The Day You Were Born!

What were the most popular baby names? What day of the week was it? How much was a loaf of bread?