GreenStar Monthly Newsletter Excerpt – October 2020

Among our goals is to help readers engage with financial news. One way to do this is explain concepts and entities that we all hear about from time to time.

This past month, Jerome Powell, the Chair of the Federal Reserve, announced that they would keep interest rates at 0% through 2023. It’s tempting to jump into how stunning this is, but for today we’ll explain the two major financial institutions in our government: the Treasury Department and the Federal Reserve.

The Treasury Department

The Treasury Department can be thought of as the bookkeepers for the United States. Think of our nation as a company, with revenue coming in mostly from taxes and money going out to cover expenses (military expenses, national parks, entitlement programs, etc.). The U.S. collects revenue through the IRS (Internal Revenue Service) and effectively “pays the bills” of the United States through the Treasury Department. If you got a stimulus check, it was from the Treasury.

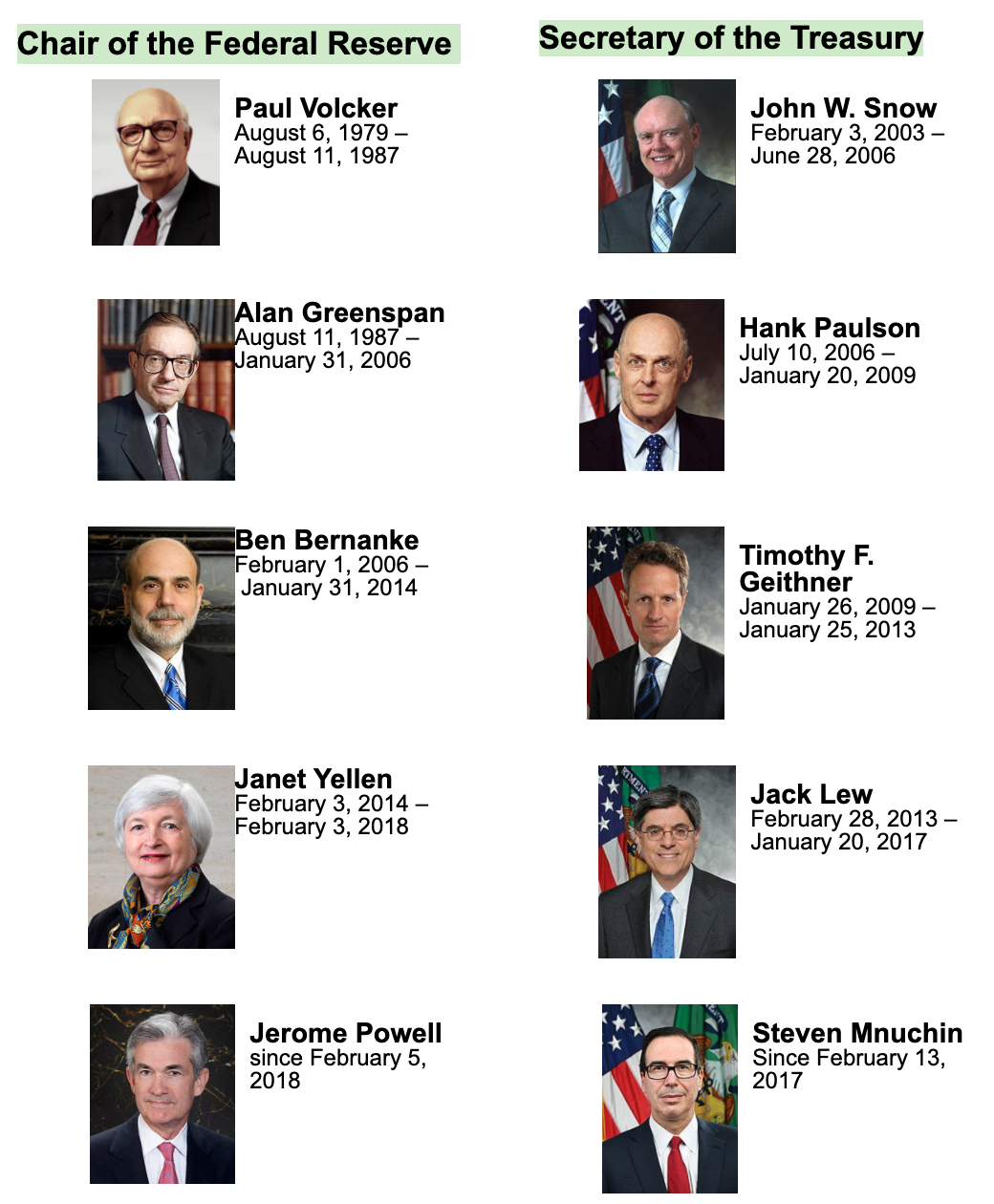

If the U.S. has more expenses than it does revenue, it will run a deficit which adds to the national debt. In order to raise the money to pay for this deficit, the U.S. Treasury will sell government debt instruments (such as bonds, notes, and bills). The Treasury Department is run by the Secretary of the Treasury. This is a cabinet level position held by Steven Mnuchin. Other prominent Secretaries were Hank Paulson and Timothy Geithner.

In addition to this, the Treasury prints and mints all paper currency and coins in circulation through the Bureau of Engraving and Printing and the U.S. Mint. These two organizations are run by the Treasurer. This is a much less public roll currently held by Jovita Carranza. It’s worth pointing out that while there has never been a female Treasury Secretary, starting 1949 every single Treasurer has been a woman. Also, 7 out of the past 11 Treasurers have also been Hispanic. Paper currency has the signature of the current Secretary of the Treasury along with the Treasurer of the United States.

The first Secretary of the Treasury was revolutionary and Tony Award winner Alexander Hamilton, who autobiographically rapped:

So maybe the real Hamilton didn’t exactly say it like that, but there is something poetically American how a person who came from nothing built the backbone of the world’s largest economy.

The Federal Reserve

The Federal Reserve is a newer entity that was created in 1913 after a series of financial panics (particularly following an especially severe one in 1907). The general purpose of the Federal Reserve is to stabilize prices, maximize employment, and moderate long-term interest rates. A key way that they do this is by lowering and increasing the Fed Funds Rate (which is the rate that a great deal of lending is based on). Two weeks ago when the Fed said rates would be 0%, they are talking about the Fed Funds Rate.

If the economy is sluggish, they will lower the rate to make it cheaper for borrowers to get money. This flood of money into the market acts as an economic stimulus. Also this stronger demand for goods should support employment. Conversely, if the economy heats up and there is too much money chasing too few goods then it can cause prices to go up (inflation) and the Fed may increase interest rates to choke out the money supply. This was famously done by Paul Volker in the early 80s to end the era of inflation.

They have additional tools to control money supply such as setting the amount of money banks must have on reserve and controlling other interest rates such as the Discount Rate.

Since the 2008 Financial Crisis, the Federal Reserve have used a new tool in their quiver called Quantitative Easing. This has been called “the Fed printing money” or more appropriately called the “Fed expanding its balance sheet.” However, they are not literally printing dirty green bills, but electronically creating money and buying stuff with it. Lately this has been U.S. government bonds from the Treasury Department, but in years past they have bought stocks and assets from troubled companies.

In March, the government passed a multi-trillion dollar stimulus bill which will result in a 2020 deficit of about $3.7 trillion dollars. Again, when the government runs a deficit, they have to sell bonds to raise the money. But who is buying these bonds? Well … about $3 trillion of is coming from the Federal Reserve expanding its balance sheet this past spring (source).

If you like feeling dizzy, let’s go down this rabbit hole. Congress passes bills to spend money the Treasury doesn’t have, so they sell Treasury bonds that nobody wants to buy, so the Federal Reserve buys the bonds with money they don’t have.

The Federal Reserve is also in charge of regulating the banking system (such as when you write or cash a check). There are 12 Federal Reserve Banks. If you look at the routing number of your check, the first two numbers tell you which Federal Reserve Bank district you are in. An account opened in Denver will start with 10, which is the Kansas City district.

Currency is issued from these 12 banks. If you pull out a bill, it will say which one issued it. In the $100 from 2009 below, it says “G7” which is Chicago’s. It would say J10 for Kansas City. In the serial number, the L corresponds to the year it was printed (in this case 2009). Also you can see the signatures of the Secretary of the Treasury and the Treasurer of the United States.

Eight times per year (roughly every six weeks), the Federal Board of Governors has a meeting and decides monetary policy – such as changing interest rates. To put some faces and names to these rolls, these have been the five most recent heads of the Treasury Department and Federal Reserve.